How to calculate my FERS Retirement amount - Government

The FERS Retirement Computation - OPM Ideas

Inflation Rate What you expect for the typical long-lasting inflation rate. A common denominator of inflation in the U.S. is the Consumer Price Index (CPI) which has a long-term typical change of 2. 5 percent yearly, from 2000 to 2010. The long term inflation rate used by the Civil Service Retirement Fund Board of Actuaries is 3.

The Federal Ballpark E$ timate uses 3. 0% as a default rate, however will allow you to choose any rate between 0% and 15. You ought to select assumptions-- or series of assumptions-- that are right for you based on your particular situations. You must pick assumptions-- or variety of presumptions-- that are best for you based upon your specific situations.

Retirement - USAGov

Excitement About FERS Retirement/Pension Calculator - Plan Your Federal

Life span information is based on group suggests, not on specific expectations. A mishap or disease may considerably reduce a person's life as compared to the group mean. On the other hand, a healthy way of life, all the best, and hereditary factors might imply that a private lives well beyond the group indicate death age.

CSRS and FERS Benefits Calculator and Retirement Income

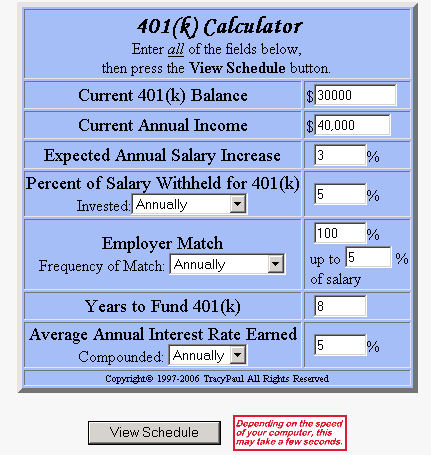

For additional information on current actuarial quotes of life span, go to the CDC site. Non-TSP Savings Any personal savings you have beyond the Thrift Savings Strategy are non-TSP savings. Enter the current balance of your non-TSP cost savings. The non-TSP cost savings amount that you go into might consist of savings from various sources such as your savings account(s), non-TSP shared funds, and non-TSP retirement funds (private sector 401-Ks, Individual Retirement Accounts, and so on).

The Only Guide for Federal Ballpark E$timate® - OPM

The summary outcome will display in present dollars and future (inflated) dollars. Likewise, if you know of any additional non-TSP cash you might be conserving yearly, enter this quantity in the Extra Annual Savings box. Post-Retirement Income Any income you make at a job after retirement should be counted in this category.

Retirees are progressively energetic, healthy, and active. They can eagerly anticipate years of life beyond retirement. Numerous senior citizens now use post-retirement work as a way to remain mentally active and keep connected to their neighborhoods, not simply as a source of extra income. fersretirementcalculator.com of Return The TSP C-Fund which approximates the S&P 500, has had an average annual 9.